A high debt ratio indicates that a company is highly leveraged, and may have borrowed more money than it can easily pay back. Investors and accountants use debt ratios to assess the risk that a company is likely to default on its obligations. This looks at the total liabilities of a company in comparison to its total assets. On the surface, this may sound like the debt ratio formula is the same as the debt-to-equity ratio formula. However, the total debt ratio formula includes short-term assets and liabilities as part of the equation, which the debt-to-equity ratio discounts.

Sales & Investments Calculators

Many startups make high use of leverage to grow, and even plan to use the proceeds of an initial public offering, or IPO, to pay down their debt. The results of their IPO will determine their debt-to-equity ratio, as investors put a value on the company’s equity. The company can use the funds they borrow to buy equipment, inventory, or other assets — or to fund new projects or acquisitions.

- Therefore, the D/E ratio is typically considered along with a few other variables.

- The other important context here is that utility companies are often natural monopolies.

- For example, if a company’s total debt is $20 million and its shareholders’ equity is $100 million, then the debt-to-equity ratio is 0.2.

- These balance sheet categories may include items that would not normally be considered debt or equity in the traditional sense of a loan or an asset.

Effect of Debt-to-Equity Ratio on Stock Price

In the realm of corporate finance, understanding a company’s financial leverage is critical for investors, creditors, and analysts alike. The debt/equity ratio stands as a fundamental metric in evaluating a company’s financial health and risk profile. This comprehensive article delves into the intricacies of the debt/equity ratio, its significance in financial analysis, calculation methodology, and interpretation. As is typical in financial analysis, a single ratio, or a line item, is not viewed in isolation. Therefore, the D/E ratio is typically considered along with a few other variables. One of the main starting points for analyzing a D/E ratio is to compare it to other company’s D/E ratios in the same industry.

Excel Formula for Debt-to-Equity Ratio

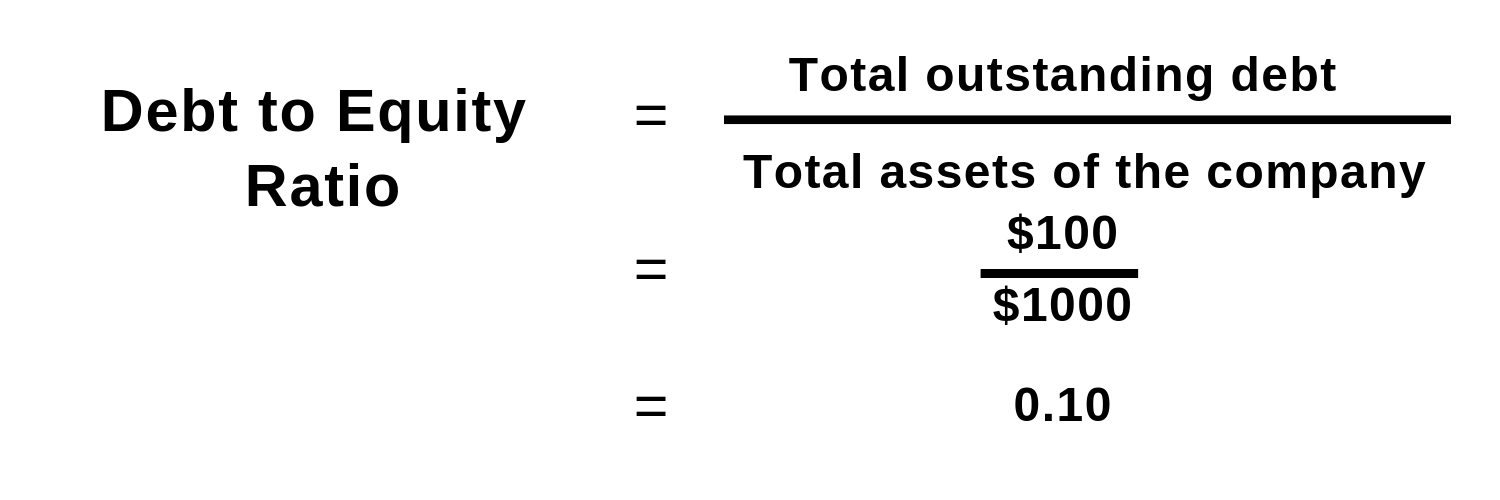

Microsoft Excel provides a balance sheet template that automatically calculates financial ratios such as the D/E ratio and the debt ratio. Additional debt issuance, debt repayment, equity issuance, stock buybacks, or changes in retained earnings can all impact the debt and equity components, leading to changes in the ratio. The weighted average cost of capital (WACC) can provide insight into the variability of a company’s D/E ratio. The WACC shows the amount of interest financing on the average per dollar of capital. You can calculate the debt-to-equity ratio by dividing shareholders’ equity by total debt. For example, if a company’s total debt is $20 million and its shareholders’ equity is $100 million, then the debt-to-equity ratio is 0.2.

What is your risk tolerance?

The D/E ratio is a powerful indicator of a company’s financial stability and risk profile. It reflects the relative proportions of debt and equity a company uses to finance its assets and operations. Another popular iteration of the ratio is the long-term-debt-to-equity ratio which uses only long-term debt in the numerator instead of total debt or total liabilities. This second classification of short-term debt is carved out of long-term debt and is reclassified as a current liability called current portion of long-term debt (or a similar name). The remaining long-term debt is used in the numerator of the long-term-debt-to-equity ratio.

Why are D/E ratios so high in the banking sector?

Suppose a company carries $200 million in total debt and $100 million in shareholders’ equity per its balance sheet. A business that ignores debt financing entirely may be neglecting important growth opportunities. The benefit of debt capital is that it allows businesses to leverage a small amount of money into a much larger sum and repay it over time. This allows businesses to fund expansion projects more quickly than might otherwise be possible, theoretically increasing profits at an accelerated rate. Taking a broader view of a company and understanding the industry its in and how it operates can help to correctly interpret its D/E ratio.

The underlying principle generally assumes that some leverage is good, but that too much places an organization at risk. However, it is crucial to compare the D/E ratio with peers in the same industry and consider the company’s specific circumstances for a more insightful analysis. For example, utilities tend to be a highly indebted industry whereas energy was the lowest in the first quarter of 2024. A high Debt to Equity ratio can lead to increased interest expenses and financial instability.

When interpreting the D/E ratio, you always need to put it in context by examining the ratios of competitors and assessing a company’s cash flow trends. Additional factors to take into consideration include a company’s access to capital and why they may want to use debt versus equity for financing, such as for tax incentives. Put another way, if a company was liquidated and all of its debts were paid off, the remaining cash would be the total shareholders’ equity.

Current assets include cash, inventory, accounts receivable, and other current assets that can be liquidated or converted into cash in less than a year. The quick ratio is also a more conservative estimate of how liquid a company is and is considered to be a true indicator of short-term cash capabilities. Utilities and financial services typically have the highest D/E ratios, while service industries 15 tax deductions and benefits for the self have the lowest. Different industries vary in D/E ratios because some industries may have intensive capital compared to others. On the other hand, when a company sells equity, it gives up a portion of its ownership stake in the business. The investor will then participate in the company’s profits (or losses) and will expect to receive a return on their investment for as long as they hold the stock.

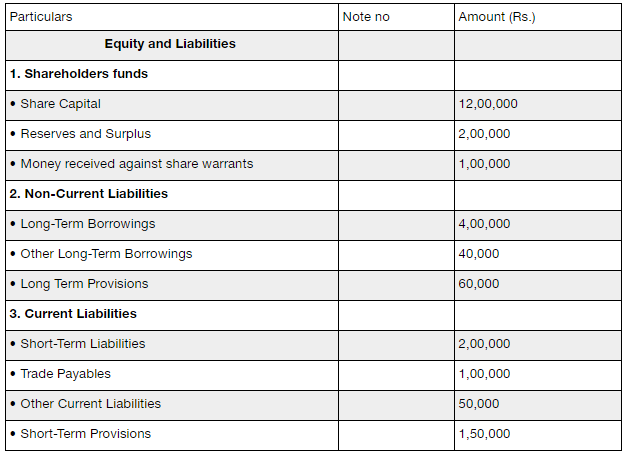

It is calculated by dividing the total liabilities by the shareholder equity of the company. Debt-to-equity is a gearing ratio comparing a company’s liabilities to its shareholder equity. Typical debt-to-equity ratios vary by industry, but companies often will borrow amounts that exceed their total equity in order to fuel growth, which can help maximize profits.

The debt to equity ratio is a financial, liquidity ratio that compares a company’s total debt to total equity. The debt to equity ratio shows the percentage of company financing that comes from creditors and investors. A higher debt to equity ratio indicates that more creditor financing (bank loans) is used than investor financing (shareholders). When using a real-world debt to equity ratio formula, you’ll probably be able to find figures for both total liabilities and shareholder equity on a company’s balance sheet. Publicly traded companies will usually share their balance sheet along with their regular filings with the Securities and Exchange Commission (SEC). The debt-to-equity ratio or D/E ratio is an important metric in finance that measures the financial leverage of a company and evaluates the extent to which it can cover its debt.